FUNDING - Purchase, Private Funding, Leasing & Private Cabin Superannuation Investment

Funding options for purchase or lease are currently being considered to enable better terms for park owners. New versions of privately owned cabins in park locations create great investment opportunities for local private super funds and investors.

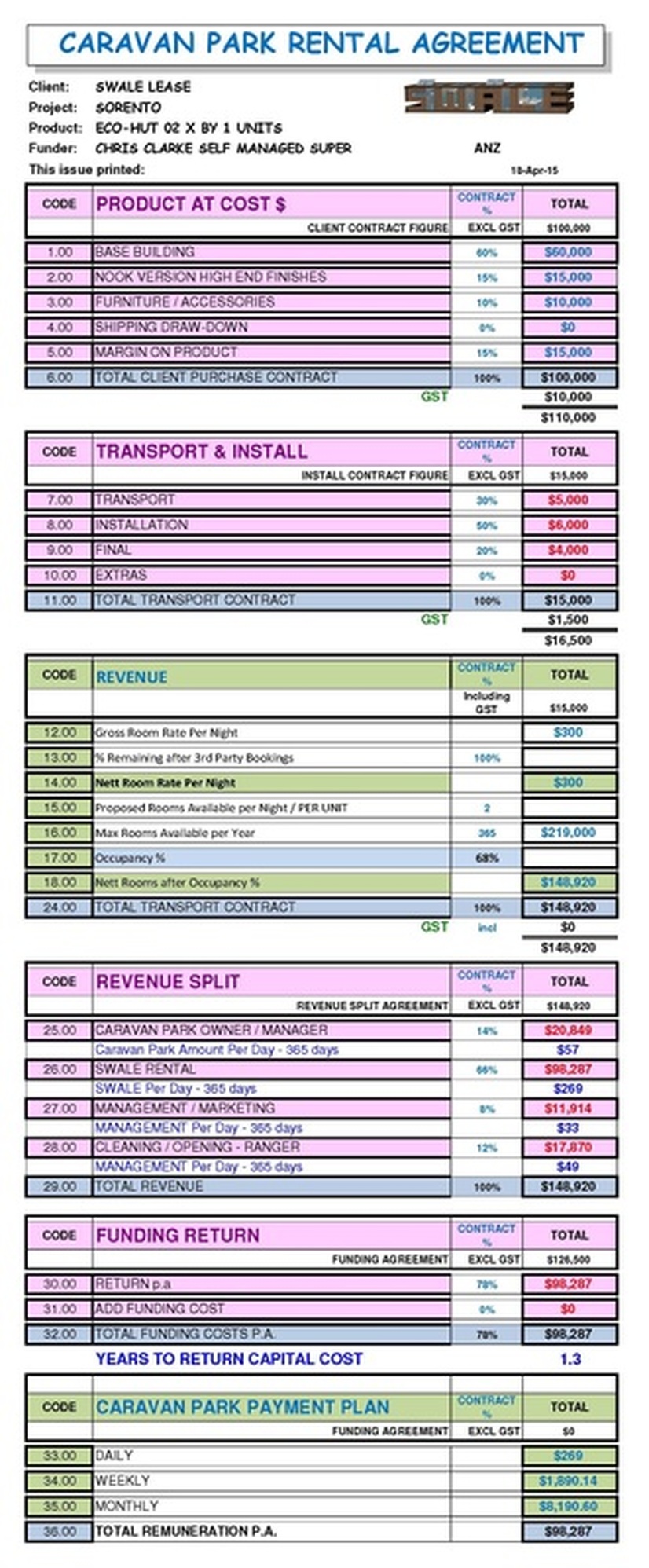

1. Outright Purchase - Cash Flow Requirements

|

return on investment - commercial lease or vendor - 12% - owner occupier (leased when not in use in conjunction with the park owner) / super fund investors - 6% borrowing funds -

|

|

2. The Concept / Market

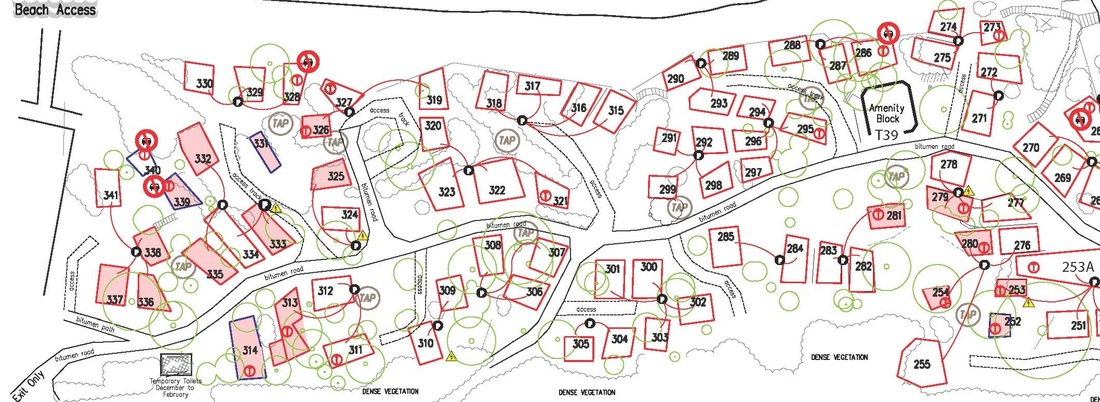

There are loads of available accommodation in the areas but limited high quality, beach front, boutique units for couples to get away or small groups to get away and enjoy the feel of camping under the trees and with the sound of the ocean. Optional extras include; Second decks nestled into the landscape in pockets of the best views with outside tables and chairs and outdoor showers.

3. The Product

An Eco-Hut 01 - 27m2 & Eco-Hut 02 - 32m2, with optional private decks and outdoor showers, placed on twist-locked sure-foot foundations without the need for excavation or machines, creates a truly 'Low Impact development' within the protected natural environment. Installed and operating within a day or two with minimal disruption to the park.

4. Feasibility / Investment Return

Disclaimer - The following figures are for this sample development and should be only used as a guide for a hypothetical situation.

5. Summary

Working on an occupancy rate of 69% and a high quality room rate of $300 per night, the investment capital excluding interest would be paid within a 2 year period and the development would provide a following XX % yield or return on investment. The cabins can be easily re-located with a minimum cost creating a more fluid, versatile investment.